- Home

- Solution

Your Brand, Our Strategy

-

Media & Visibility Solutions

-

Brand & Communication Solutions

Your Challenges, Our Smart Solutions

Let’s Talk Let’s Talk

-

- Agency

- Pricing Plan

- Media Hub

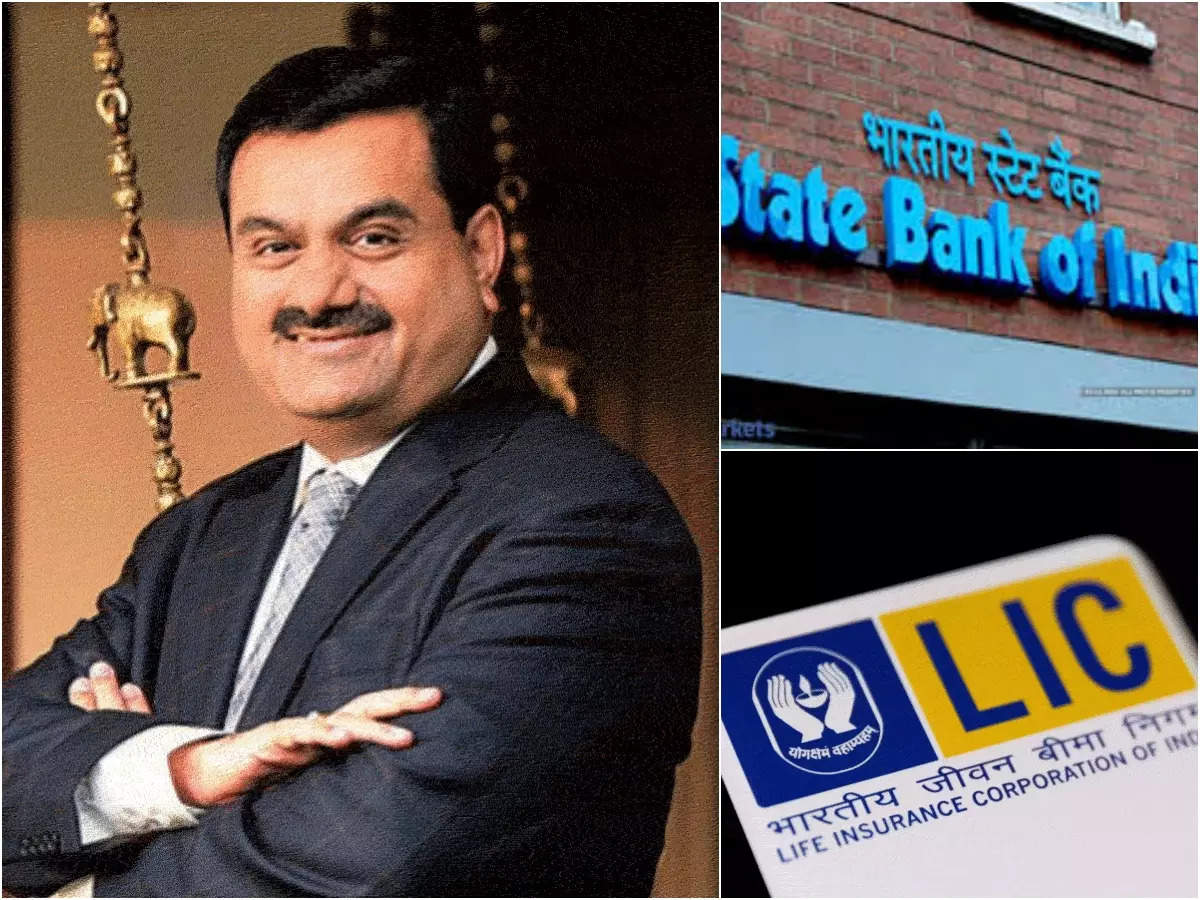

India’s largest life insurer is pouring more money into Gautam Adani’s flagship unit, undeterred by allegations of a short sale fraud that wiped more than $50bn off the group’s market value in two sessions.

According to a document, Life Insurance Corporation of India is spending around Rs 3 billion ($37 million) as a lead investor in a new $2.5 billion share sale of Adani Enterprises Ltd. The investment will be added to the current share of 4.23. ,

With its investment on January 25, LIC showed its support for Asia’s richest man and his troubled company, which was facing its hardest test yet in the wake of US-based Hindenburg Research. LIC is one of 33 institutional investor anchors in the FPO, along with companies including Al Mehwar Commercial Investments LLC and the Abu Dhabi Investment Authority.

While Mumbai-based LIC’s investment is relatively small, with LIC having around Rs 43 trillion in assets under management, it starkly contrasts with other domestic financial institutions to which Adani has little to no exposure. This also affected shares exposed to the Adani group, including LIC, which fell the most in over a month in Mumbai on Friday.

Arun Kejriwal, the founder of Kejriwal Research and Investments, said: “LIC thinks otherwise.” “You had always made money when the market was volatile. The money is not available for a short time. It acts as a long-term fund.

Emails and texts sent to the LIC president seeking comment on the Adani group’s investment were not immediately returned.

LIC is one of India’s most systemically significant institutions, with more than 250 million policyholders and assets under management that rival the size of the nation’s mutual fund sector. Exposure to the Adani group, whose development objectives are well known to be closely matched with those of Prime Minister Narendra Modi, is another indication of the tycoon’s political weight.

A stake in five Adani companies owned by LIC ranges from 1% to 9%. There are no other Indian insurance companies that have a sizable interest, according to the December 2022 data that was posted on the stock exchanges. Although certain stocks have had significant gains, most mutual funds have avoided this group. For instance, Adani Enterprises has increased by more than 1,900% over the last five years, outpacing even Elon Musk’s Tesla Inc.

According to Jairam Ramesh, a politician with the opposition Indian National Congress party, the significant exposure of state-backed financial institutions “has repercussions for financial resilience” and for the millions of Indians “whose funds are stewarded by these pillars of the financial system.”

Such worries might gain more traction due to the selloff sparked by Hindenburg’s report. On Thursday, the downturn worsened as some stocks, including Adani Green Energy Ltd. and Adani Total Gas Ltd., fell over their 20% daily limit. Adani Enterprises decreased by 19%.

The short seller claims that Adani Group engaged in “brazen” accounting fraud and market manipulation, employed offshore shell businesses for money laundering, and stole from publicly traded companies. According to the company, the report is “a nasty blend of selected falsehoods and outdated, unsubstantiated, and debunked charges.” It said that legal action is also being considered.

Jugeshinder Singh, the chief financial officer (CFO) of the Adani Group, admitted the lack of enthusiasm among domestic institutional investors last week.

At a press conference, he stated, “We recognise mutual funds missed the Adani growth stock boom.” “We ought to have informed the mutual funds.”

More news: Click here